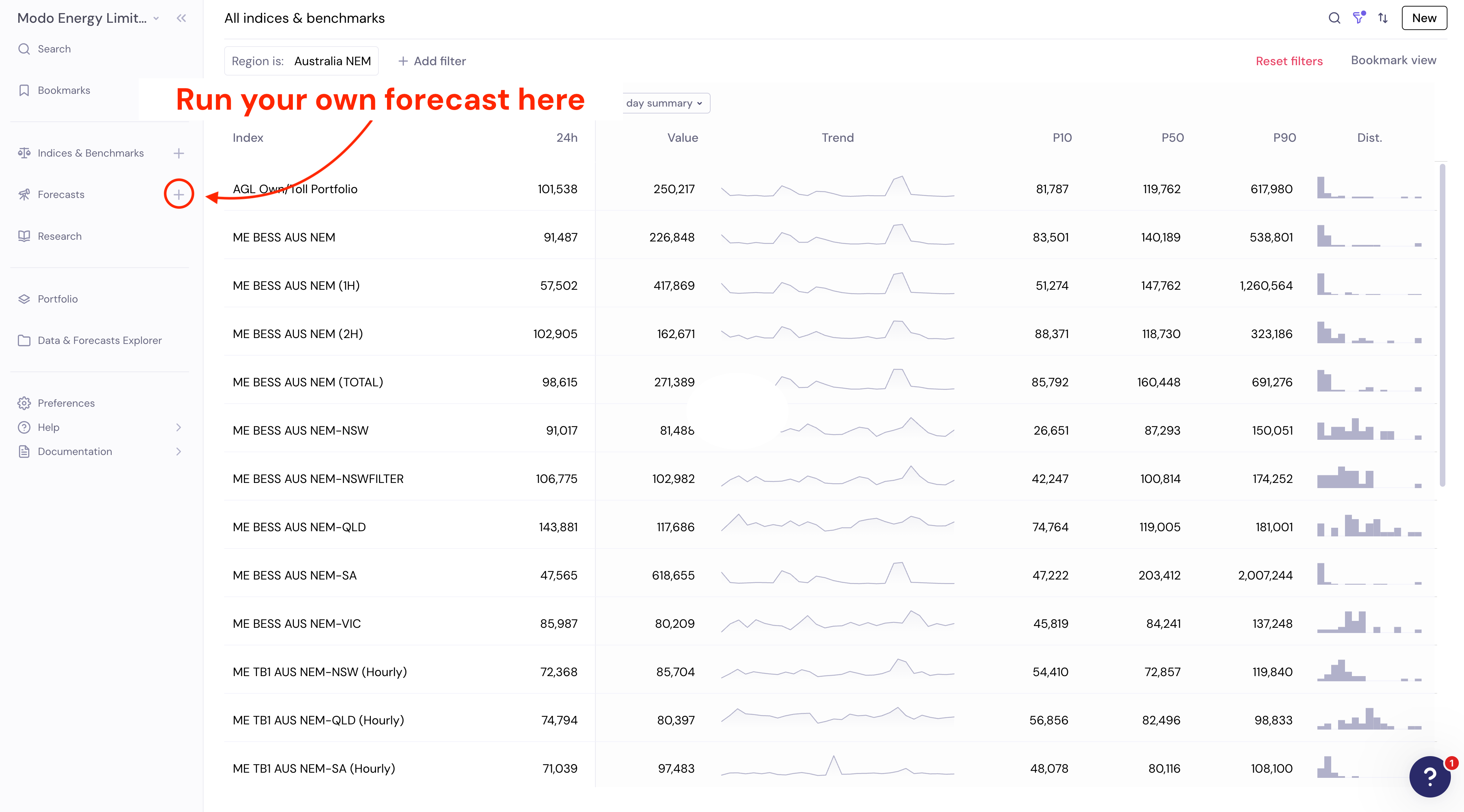

For a truly bespoke forecast, we can complete custom runs for you to match the exact configuration of your asset across different markets and regions.

Custom runs enable full flexibility to configure your forecast parameters to match your specific asset and market conditions. The available parameters vary by market and asset type, but typically include the following:

Required parameters

These parameters are mandatory for generating a forecast.

Address: Providing the precise geographic location of your asset allows for a more accurate forecast, accounting for location-specific factors such as transmission losses, local network conditions, and nodal pricing where applicable.

Region: Specify the market region for your asset. Depending on the market, you may need to specify sub-regions to more accurately model local network conditions and constraints.

Rated Power: The maximum continuous power output of your battery energy storage system, measured in megawatts (MW). This can be set from 5 MW to 300 MW.

Duration: The amount of time your battery can discharge at its rated power before being fully depleted, measured in hours. You can configure this from 6 minutes (0.1 hours) up to 8 hours.

Max Daily Cycles: This sets a limit on the maximum number of full charge-discharge cycles your battery can perform in a single day. This is a key parameter for managing battery degradation and operational strategy. You can set this to a value between 0 and 3.

Commercial Operational Date: The date your asset is expected to become commercially operational. This will be the start date for the forecast. The available forecast horizon varies by market.

Optional parameters

These parameters can be configured to refine your forecast, but have default values if not specified.

Scenario: This parameter sets the macroeconomic and energy market outlook for the forecast. You can choose from our ‘CENTRAL’, ‘HIGH’, and ‘LOW’ scenarios, which are based on different assumptions about future fuel prices, demand growth, and renewable energy build-out. Available scenarios vary by market.

Revenue Strategy: Define how your asset will operate to maximize revenue. These can vary by market by typically include some variation of:

- Energy Only: The asset will perform energy arbitrage, charging when wholesale prices are low and discharging when they are high.

- Energy + Ancillary Services: The model will co-optimize revenue streams from both energy arbitrage and participation in ancillary services markets (such as frequency response, capacity markets, or other grid services depending on the region). This allows the asset to dynamically allocate its capacity to the most profitable service at any given time.

Model Degradation: You can choose whether to model the effects of battery degradation over the forecast period. If you enable this, the model will account for the gradual loss of capacity and efficiency as the battery ages.

Cycles Before Repowering: If degradation is enabled, this parameter defines the total number of equivalent full cycles the battery can undergo before it is “repowered” back to its original nameplate capacity.

Round-trip Efficiency: The efficiency of a full charge and discharge cycle as a percentage. The default value is 88%, but you can set a custom value between 1% and 100% to match your specific hardware.