Overview of revenue streams available to battery storage in the German market

Available Markets

In Germany, battery storage assets can participate in the following revenue streams:

Energy Markets

| Market | Granularity | Description |

|---|---|---|

| Day-ahead | 15-minute | Main wholesale market cleared day before delivery |

| Intraday Auctions and Continuous Market | 15-minute | Continuous trading up to 5 minutes before delivery |

Ancillary Services

| Service | Product Duration | Procurement | Description |

|---|---|---|---|

| FCR | 4-hour blocks | Day-ahead | Primary frequency control with symmetric provision |

| aFRR Capacity | 4-hour blocks | Day-ahead | Secondary frequency control capacity reservation |

| aFRR Energy | 15-minute | Real-time | Energy payments for activated aFRR |

Day-ahead Market

The day-ahead market is the primary wholesale market where most energy is traded. Key characteristics:

- 15-minute granularity – finer resolution than hourly markets in other countries

- Single clearing – market clears once per day for all delivery periods

- Pay-as-cleared – all accepted bids receive the marginal clearing price

Batteries participate by offering to charge during low-price periods and discharge during high-price periods, capturing the spread.

Intraday Market

The intraday market allows participants to adjust positions after the day-ahead market closes:

- Continuous trading – trades executed as matched, not in discrete auctions

- Gate closure – 5 minutes before delivery (one of Europe’s shortest)

- Price volatility – prices can deviate significantly from day-ahead as forecasts update

This market is increasingly important for batteries as renewable forecast errors create trading opportunities close to real-time.

Frequency Response Services

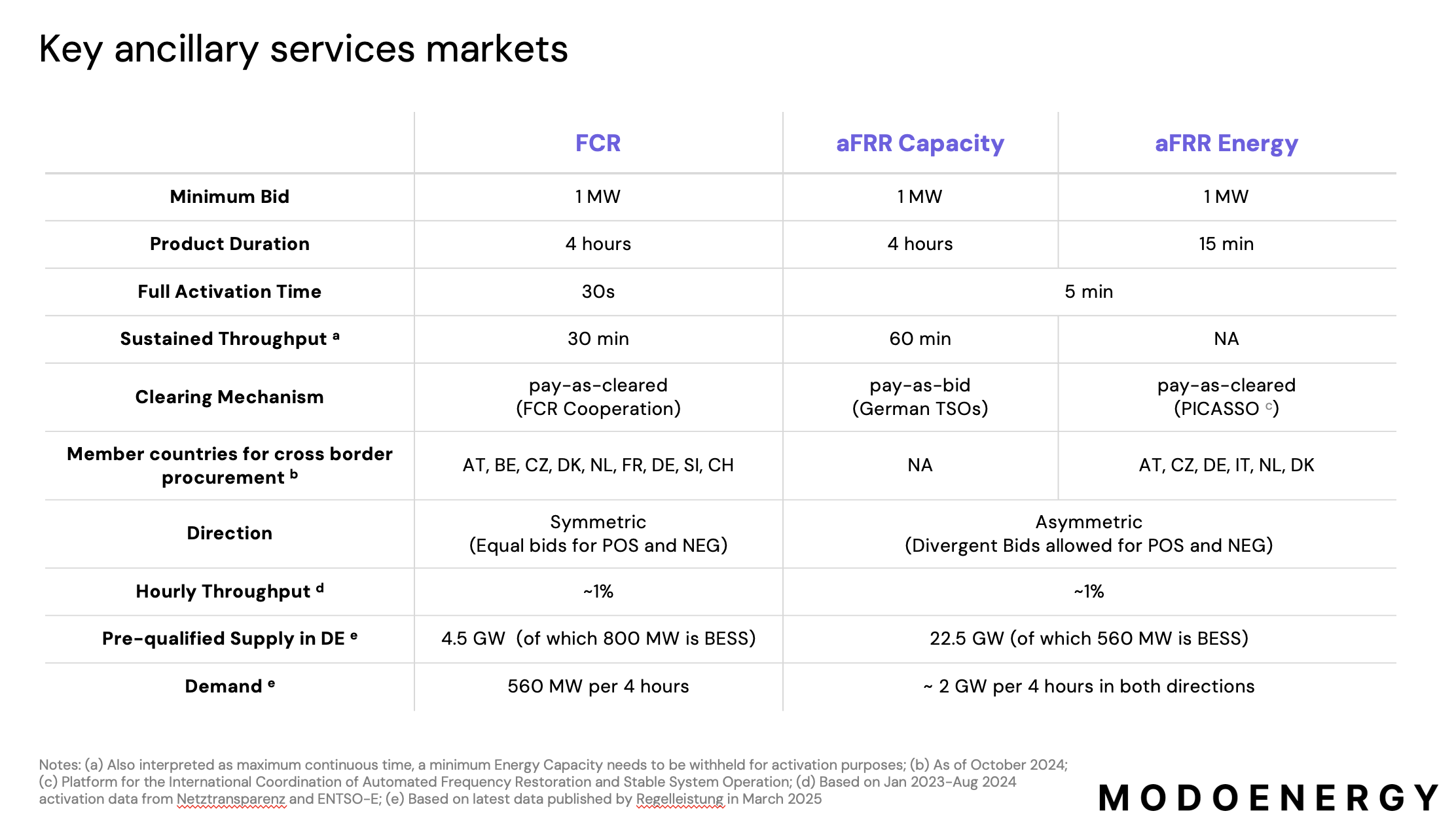

Frequency Containment Reserve (FCR)

FCR is the fastest-responding frequency service, activated automatically when grid frequency deviates from 50 Hz:

- Symmetric provision – equal capacity must be offered in both directions (charge and discharge)

- 4-hour blocks – capacity contracted in 4-hour windows

- Cross-border procurement – traded through the FCR Cooperation platform with AT, BE, CZ, DK, NL, FR, SI, CH

- Pay-as-cleared – marginal pricing through the cooperation

- Full activation time – 30 seconds

- Minimum bid – 1 MW

Automatic Frequency Restoration Reserve (aFRR)

aFRR is secondary frequency control that restores frequency after FCR activation:

- Asymmetric products – separate positive (upward) and negative (downward) capacity

- 4-hour blocks – capacity contracted day-ahead

- Pay-as-bid – capacity payments at bid price (German TSO procurement)

- Full activation time – 5 minutes

- Minimum bid – 1 MW

aFRR Energy Activation

When aFRR capacity is called upon, energy payments are made separately:

- 15-minute granularity – energy settled at quarter-hour resolution

- Pay-as-cleared – through the PICASSO platform (AT, CZ, DE, IT, NL, DK)

- Real-time procurement – activated based on system needs

Key Market Parameters

Related Pages

- Dispatch Model – How the model optimizes across these revenue streams

- Capacity Expansion Model – Projected BESS buildout in Germany