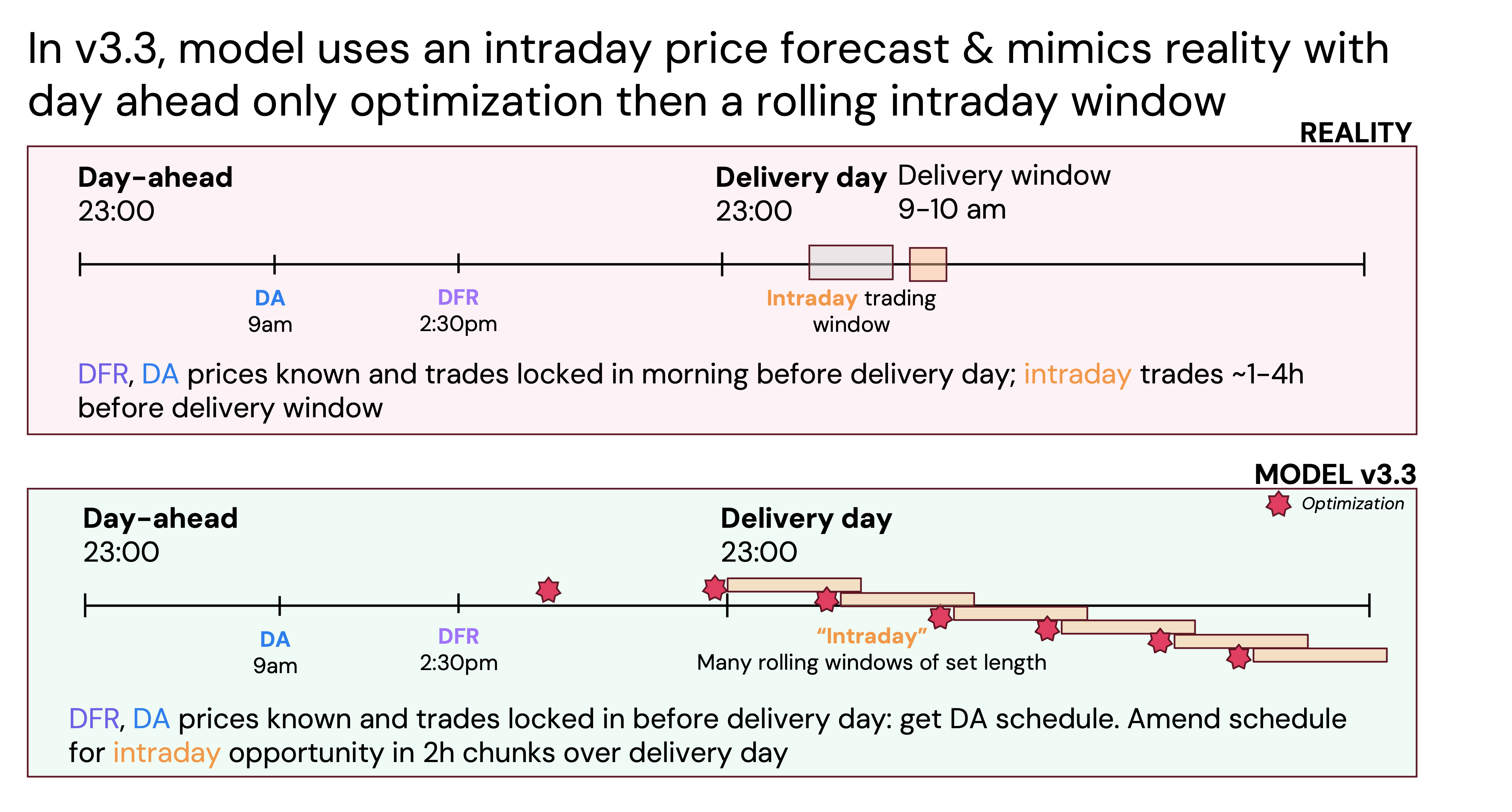

Modo produces an intraday price forecast, as well as a day-ahead price forecast.

We provide a forecast of revenues from re-optimising a battery in intraday markets, given a day-ahead position which considers day-ahead wholesale pricing and ancillary service contracts. This is shown as a revenue line ‘Intraday Revenues (£/MW)’ in our downloadable curves.

It is new in our v3.3 release and replaces an intraday uplift that was previously used. It represents a more realistic view of intraday revenues.

This section describes how we optimise a battery against intraday prices to get intraday revenues, within our dispatch model. Find information on how we generate intraday prices here.

Modelling intraday battery dispatch

Once we have the forecast of the EPEX intraday continuous RPD HH price, we plug it into the dispatch model.

The intraday continuous market is continuous: it’s an order book in which trades can be placed anything from ~18 hours out from delivery to 20 minutes beforehand (with most volume traded ~2 hours from delivery). In the real world, trading decisions made, say, 4 hours out will impact decisions 3, 2, or 1 hour out, with factors like liquidity an issue. It’s often a very fluid picture. The reality is quite different to a 24-hour perfect foresight model.

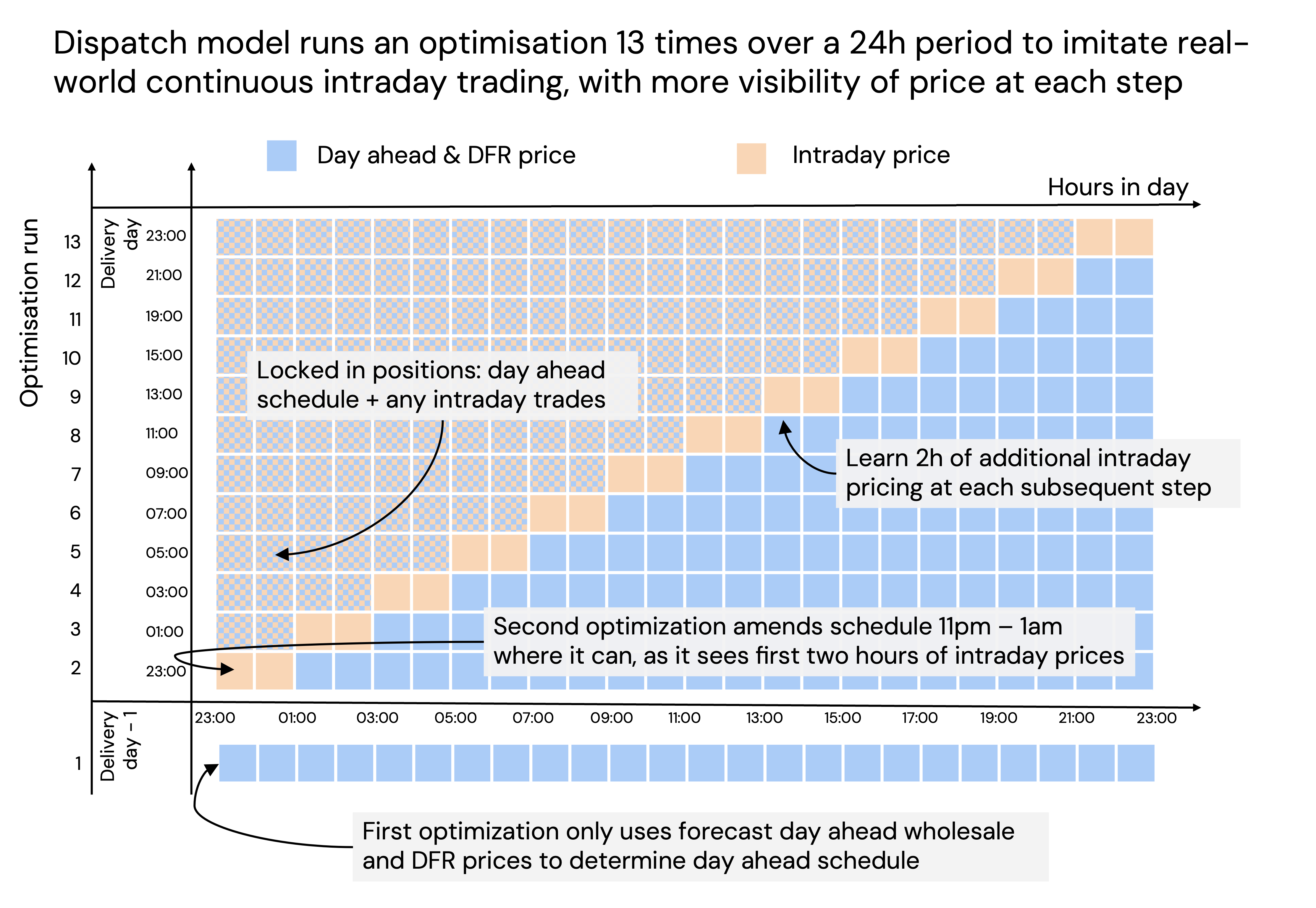

To try and mimic continuous intraday trading, we perform multiple optimisations.

- First, we lock in the day-ahead position using the wholesale day-ahead price forecast and any ancillary contracts using the Dynamic Frequency Response price forecasts. These can introduce constraints on parameters like the battery’s state of charge, which are respected in subsequent optimisations.

- This day-ahead position is then re-optimised in many steps across the delivery day. Multiple optimisations are run in increments of 2h, and the price signal for the rest of the day is adjusted to consider the intraday price for the first 2h of the new optimisation window.

The result is 13 optimisations for each 24-hour period of our forecast: