Summary

Batteries are optimised across the Dynamic Frequency Response suite, and the day-ahead wholesale market.

We take:

- Forecast day-ahead power prices

- Forecast Dynamic Frequency Response prices

- Battery power, duration, efficiency

- Desired cycling

and use a dispatch model to decide how much money a battery can make in wholesale day-ahead markets and each of the Dynamic Frequency Response markets (Dynamic Containment, Moderation, and Regulation; high and low), respecting all the rules of each service.

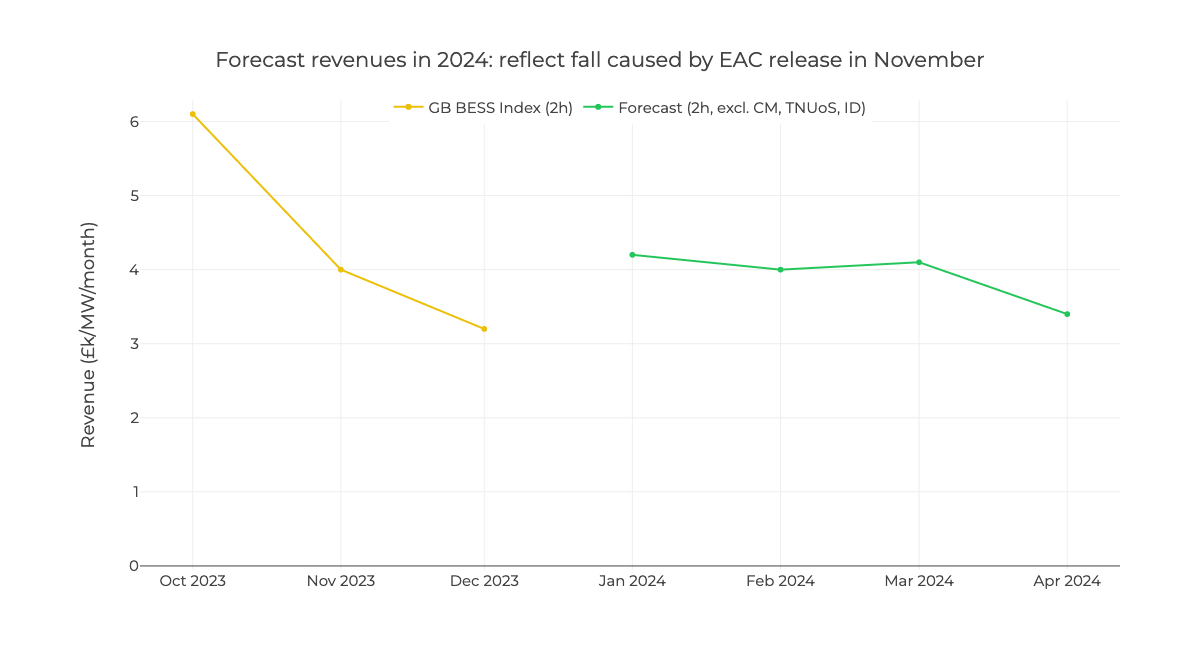

Frequency Response market saturation is modeled (see Frequency Response Requirements), and we also model the new EAC prices. As a result, frequency response revenues are low (quite a bit lower than we’ve seen historically… just check out the last few months of the Modo Benchmark).

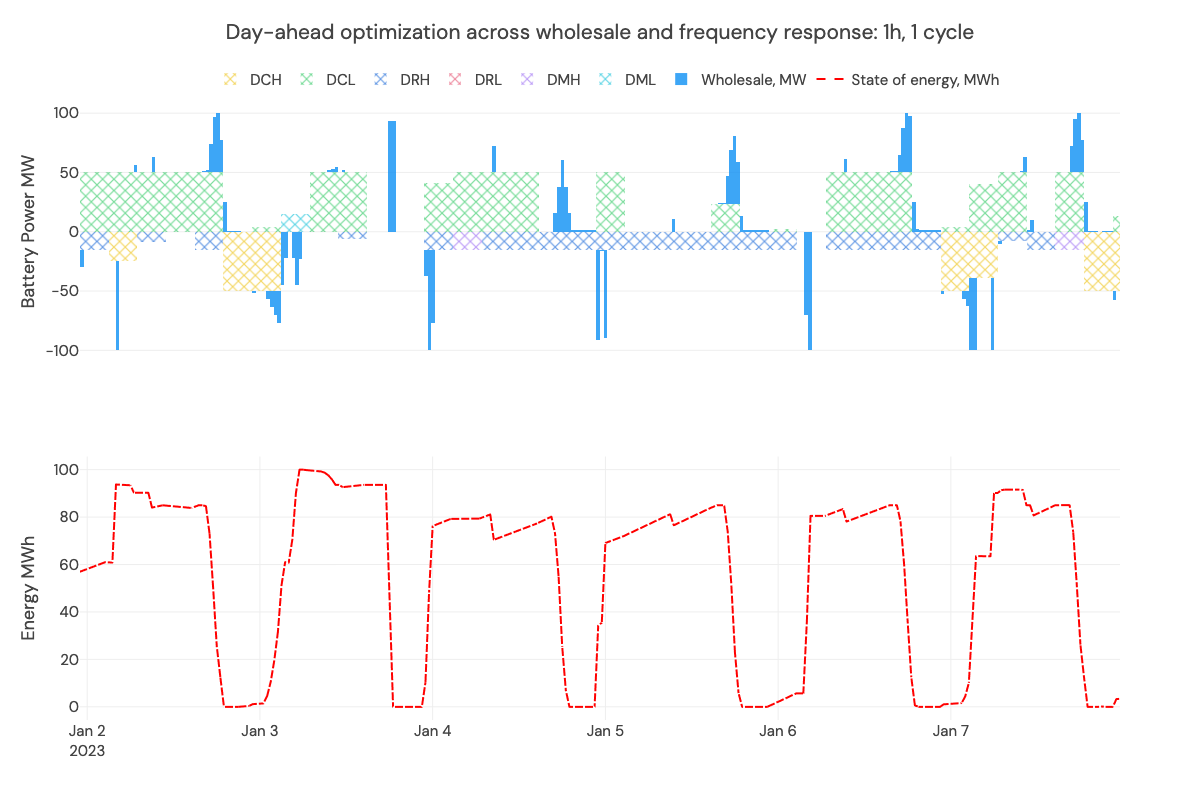

The below example shows a 1-hour battery, limited to cycling (up to) once daily, being optimized across wholesale and frequency response markets.

Volumes in Dynamic Containment (high and low) are higher than Dynamic Regulation and Moderation, as volume requirements and, therefore average battery participation in this market are higher.

We make various assumptions and respect the rules to decide what the battery does

- Check these out in Key Assumptions.

Frequency Response Market Saturation limits battery revenues

- We restrict how much Dynamic Frequency Response a battery can do, due to the increasing competition in these markets as the storage fleet grows. More on this in Frequency Response Requirements.