Welcome to the methodology for Modo Energy’s NEM battery energy storage revenue forecast. In October we hosted a livestream on the outlook for energy storage in the NEM, introducing the forecast and highlighting key trends in the market.

A radically different battery revenue forecast

- Built in-house: our entirely new model is built from the ground up and gives a fresh view of future revenues for battery energy storage.

- Data-driven for storage: we use our industry-leading view of today to model storage for tomorrow and beyond at 5 minute granularity out until 2055.

- Transparent: core inputs are based on reputable third parties like AEMO and CSIRO, as well as our own internal assumptions. For full transparency, the model and method are detailed in this guide.

- Principled: we’ve built the forecast we would use. It’s plug-and-play into a business model, highly locational, and uses the latest Modo Energy benchmarking and research data to inform, adapt, and explain.

- A capacity buildout that reflects the real world: commercially scalable and proven technologies realistically respond to economics. Our capacity expansion model iterates on the build-out of gas, battery energy storage and renewables.

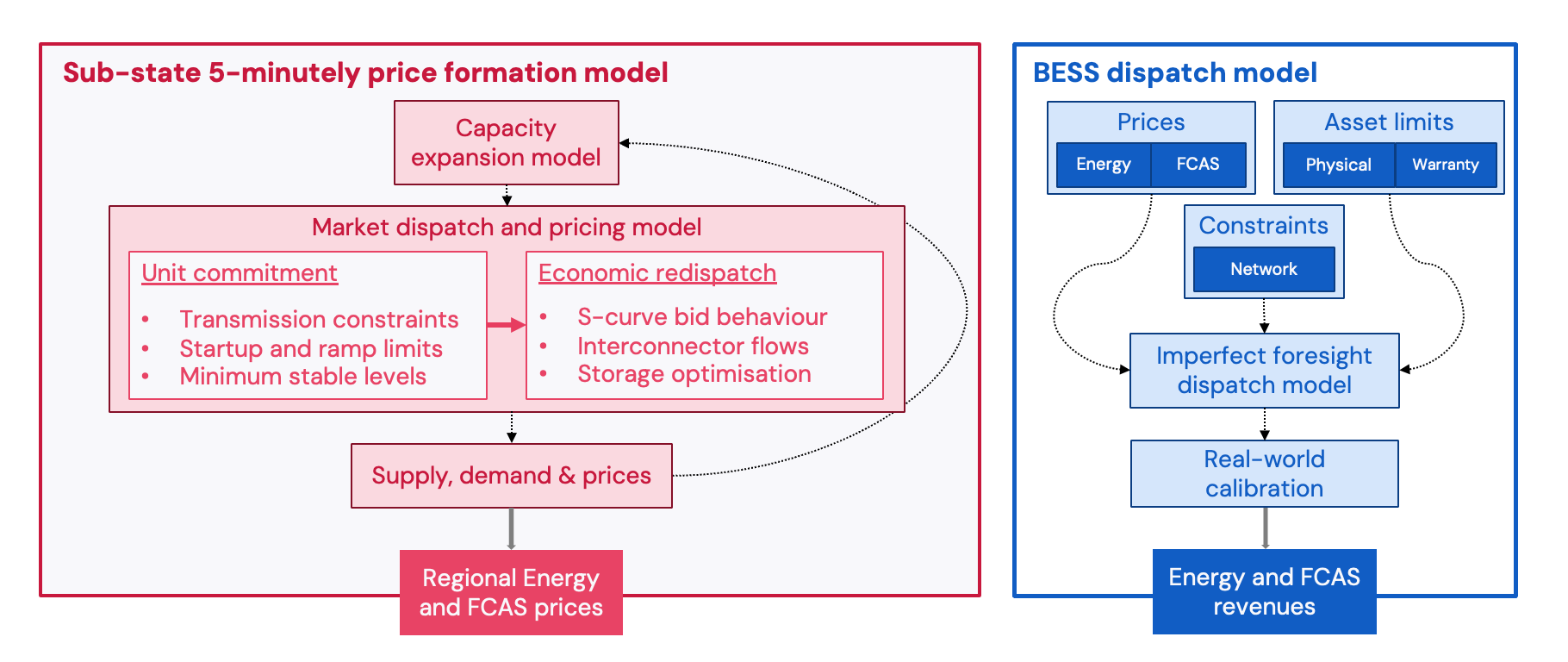

Our model is made up of two parts

- Fundamentals model for energy and FCAS prices in the spot market. These are driven by five-minutely supply stacks, informed by a techno-economic capacity build-out, variable short-run marginal costs and storage optimisation.

- Battery dispatch model using mixed integer linear programming to maximuse revenues in energy and FCAS markets. This is based on imperfect foresight of modelled prices, as well as the specific configuration chosen by a user. Our market-leading optimisation and parallelisation allows this forecast to run in the cloud in 12 minutes.

Check out the major components of the forecast in more detail by clicking a section below.