How the model optimizes battery dispatch across Spanish markets

Getting Started

The Spanish dispatch model builds on our core dispatch model framework. For a comprehensive overview of the dispatch model architecture, optimization approach, and key components, see the Core Dispatch Model documentation.

For an overview of available revenue streams and market structures specific to Spain, see the Revenue Stack page.

Spain Export Taxes

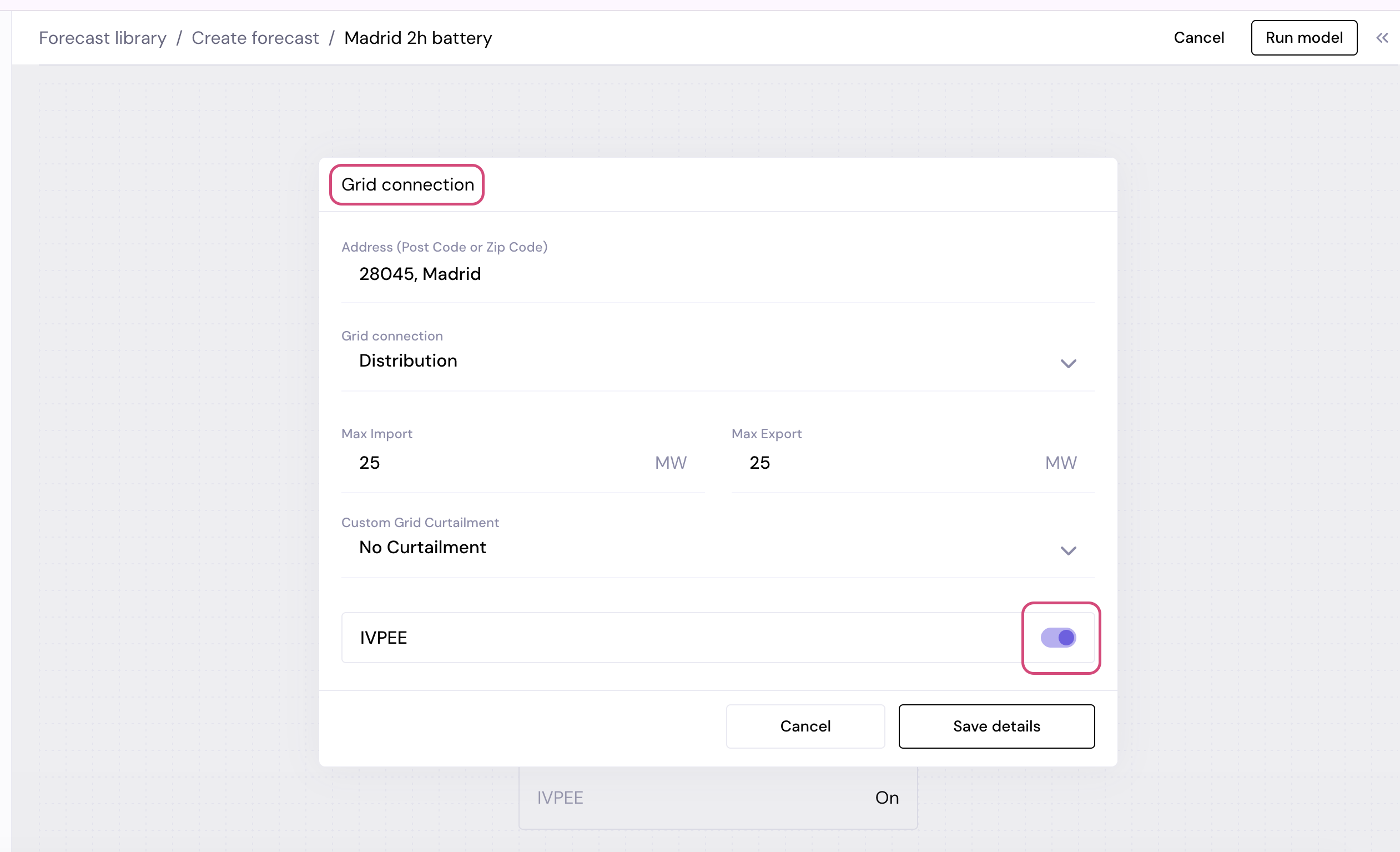

Spain levies a 7% tax on the value of electricity production (Impuesto sobre el Valor de la Producción de Energía Eléctrica – IVPEE). In the model, this is applied to gross revenue from selling electricity to the grid, including battery discharge and renewable exports (solar and wind). It can be toggled on or off in the forecast run form using the toggle on the ‘Grid Connection’ input data on the ‘Create Forecast’ flow, shown below.

Background: IVPEE Tax

The IVPEE is a 7% tax on electricity production value:

- Standard rate: 7% of gross revenue from electricity sales

- Applies to: Battery discharge revenue and renewable export revenue (solar and wind)

- Battery treatment: Charged on all discharge sales revenue (turnover), even if the battery buys back later, or cycles multiple times within the same period

- Suspended period: The tax was suspended from Q3 2021 through 2023

- Reactivation: Progressively reactivated in 2024 (50% taxable base in Q1, 75% in Q2, full rate from Q3)

The tax is calculated on revenue, not volume. Higher power prices result in proportionally higher tax costs.

If the tax toggled on, it reduces overall revenues

It is applied to battery discharges in both the energy and ancillary markets. The tax effectively reduces the value of all export revenue by the tax rate. This can shift optimal dispatch by:

- Reducing arbitrage margins – The spread required to profitably cycle the battery increases

- Affecting market prioritization – Relative value between energy and ancillary markets may shift

- Lowering overall revenue – Total achievable revenue decreases by approximately the tax rate

Results Reporting

When export tax is enabled, additional rows appear in the results:

| Column | Units | Description |

|---|---|---|

Battery Export Tax Revenue |

€/MW/period | Tax cost on battery discharge revenue (negative) |

Solar Export Tax Revenue |

€/MWp/period | Tax cost on solar export revenue (negative) |

Wind Export Tax Revenue |

€/MWp/period | Tax cost on wind export revenue (negative) |

Related Pages

- Revenue Stack – Overview of available revenue streams in Spain

- Core Dispatch Model – Global dispatch model architecture and methodology