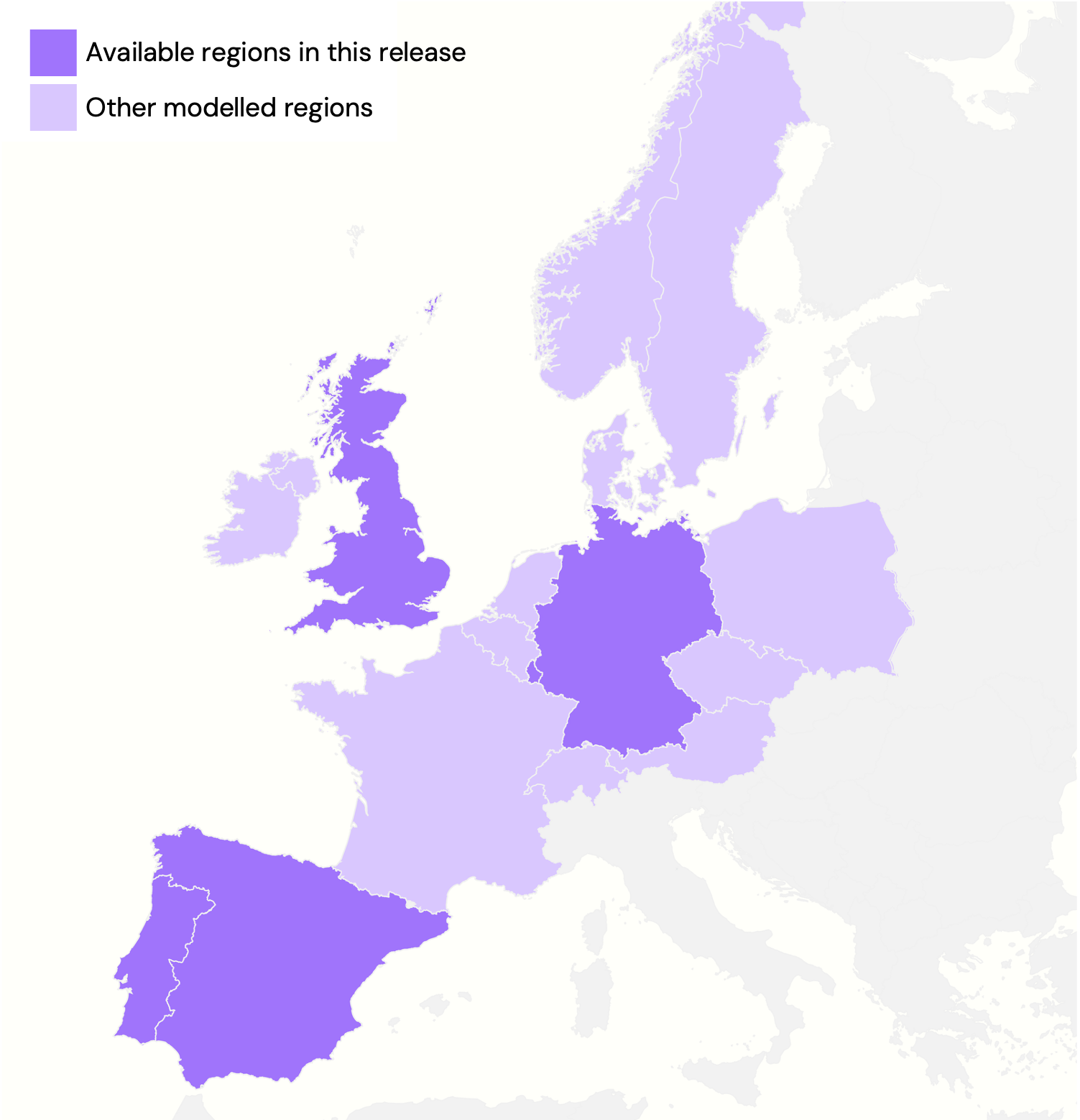

The Modo Energy European power price forecast models 15 bidding zones out to 2060, generating 15-minute prices for electricity and ancillary services in Great Britain, Germany, and Spain. See our backtest results for validation.

Pan-European modelling

To reflect the highly interconnected dynamics of the European electricity system, we model 15 different regions: Great Britain, Germany, France, Spain, Portugal, Italy, Belgium, Netherlands, Austria, Switzerland, Poland, Norway, Sweden, Denmark, and Ireland.

A region is defined as a country or a combination of countries that make a bidding zone (namely, Germany and Luxembourg).

Find country-specific methodology and assumptions:

- Great Britain — Dispatch model, network charges, Balancing Mechanism

- Germany — German market structure and dispatch considerations

- Spain — Spanish market structure and dispatch considerations

Prices for every 15-minute period

The model runs at 15-minute granularity to build a full time series of electricity and ancillary services prices from 2026 to 2060.

Modelling at 15-minute granularity aligns with European wholesale power markets, after the day-ahead market moved from hourly to 15-minute trading intervals on 30th September 2025. It is also critical to maximise the value that battery energy storage can capture from volatility and both day-ahead and intraday markets.

The chart below is interactive—hover over data points to see exact values.

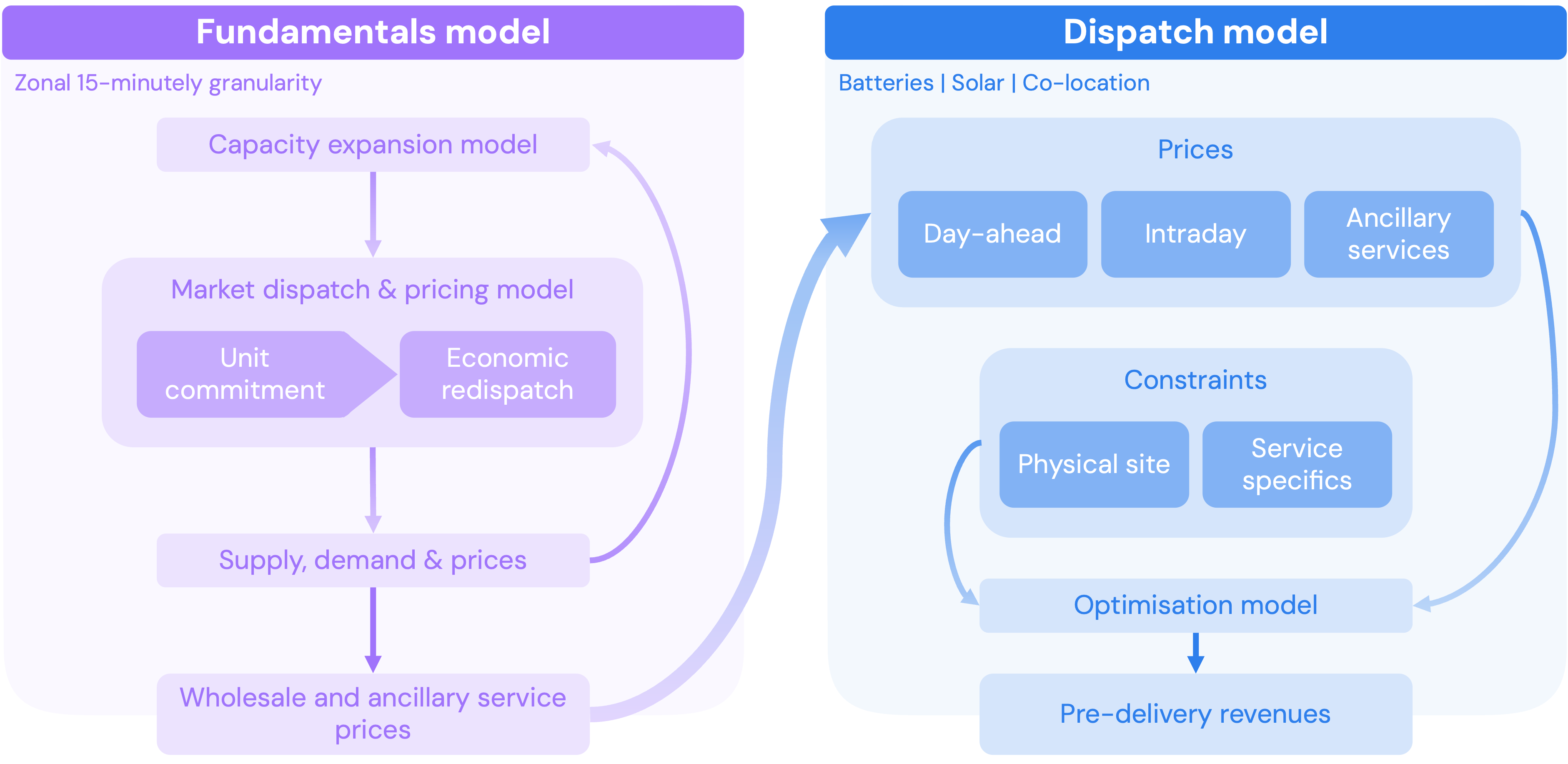

Modelling overview

The model can be broken down into three parts: a Capacity Expansion Model determines the future generation stack of the electricity system; a Market Dispatch and Pricing Model imitates the power markets; and a Dispatch Model uses those market signals and asset information to forecast the revenues for an individual site.

The underlying model relies on Modo Energy’s core forecast models, applied to Great Britain and Europe.

1. Capacity Expansion Model

Models which power plants will be built, retired, or re-powered in the future — and when. It uses economic optimisation, technology competition, and rolling window planning across 15 regional bidding zones, and incorporates EU-specific policies.

2. Market Dispatch and Pricing Model

Generates energy and ancillary services prices for the spot market (day-ahead and intraday). It uses Modo Energy’s core Production Cost Model to mimic supply stacks, unit commitment, and merit order dispatch at 15-minute granularity with zonal pricing. European specific inputs are listed below.

Core inputs

The model uses Modo Energy’s independently developed market outlook, informed by data from BNetZa, ENTSO-E, ESIOS, NESO, and NREL.

| Category | Key input sources |

|---|---|

| Demand | ENTSO-E’s TYNDP 2024 and ERAA 2024, NESO’s FES 2025 |

| Generation capacity | BNetZa, ENTSO-E, individual TSOs |

| Interconnectors | ENTSO-E |

| Commodity prices | Verified 3rd Party, Deloitte, IEA, Modo Energy, Oxford Economics |

| Renewable load factors | ENTSO-E, Renewables Ninja |

| Thermal generators outages | ENTSO-E |

| CapEx and OpEx | Modo Energy’s GB CapEx survey, NREL ATB 2024 |

3. Dispatch Model

Uses mixed integer linear programming to co-optimise battery, solar, and co-located asset dispatch into energy and ancillary services markets.

-

Assumptions in the dispatch model for Great Britain, Germany and Spain

Explore the fundamental model’s components

Demand

How we forecast electricity demand across European markets

Generation and Storage

Generation capacity assumptions and forecasting methodology

Storage

Energy storage modeling and market participation

Interconnection

Cross-border transmission and market coupling

Ancillary Services

Frequency response, reserves, and system services

Day-Ahead vs Intraday

Understanding the different European power markets

Backtest

Historical accuracy and model validation