Modelled revenues are adjusted to reflect real-world trading performance, ensuring forecasts align with what batteries actually earn.

At a glance:

- Benchmark: Forecasted revenues are calibrated against the Modo Energy BESS Index, tracking all operational GB battery sites

- Approach: The 75th percentile of fleet revenues is used to keep calibration relevant to newer, better-performing assets

- Adjustment: Modelled revenues are reduced by 15-25% depending on the scenario, reflecting real-world factors like availability, imperfect foresight, and market competition

- Result: Near-term forecasted revenues align with actual market performance

Modelled revenues need adjustment to reflect real-world performance

A fundamentals-based dispatch model calculates theoretical revenues assuming optimal trading decisions and perfect market knowledge. In practice, operational realities mean actual revenues are lower than these theoretical optimums.

The calibration process compares modelled revenues against actual fleet performance and applies an adjustment factor. This ensures the forecast reflects what batteries genuinely earn, rather than what they could earn under idealised conditions.

This calibration is currently applied to GB battery forecasts.

The Modo Energy BESS Index provides the benchmark for real-world revenues

The Modo Energy BESS Index tracks revenues for every battery energy storage asset above 7 MW across Great Britain. As of early 2026, this covers over 190 sites representing nearly 7 GW of installed capacity.

The index records earnings across all major revenue streams:

- Day-ahead wholesale markets: Revenue from trading power one day ahead

- Intraday markets: Revenue from shorter-term trading closer to delivery

- Frequency response: Payments for providing grid-balancing services

- Balancing Mechanism: Revenue from accepting instructions from the system operator

- Capacity Market: Fixed payments for being available during system stress

This comprehensive dataset provides the real-world benchmark against which modelled revenues are compared.

The 75th percentile approach keeps calibration relevant to new assets

The GB battery fleet contains assets ranging from brand new to over seven years old. Performance varies significantly across this range.

-

Newer assets benefit from improved cell technology, better thermal management, and more sophisticated optimisation strategies. These batteries typically achieve higher revenues per MW of capacity.

-

Older assets may have experienced significant degradation from nameplate capacity. They often have more conservative cycling strategies and may accept lower prices in competitive markets due to lower opportunity costs.

Using the 75th percentile of fleet revenues (rather than the median) ensures the calibration remains representative of modern, well-operated battery projects. This is the most relevant benchmark for investors evaluating new-build projects or recently commissioned assets.

Several real-world factors explain the gap between modelled and actual revenues

The calibration captures multiple operational realities that reduce revenues below theoretical optimums:

-

Availability: Batteries are not available 100% of the time due to grid outages, transformer maintenance, or cell issues. This accounts for approximately 5% of the revenue difference.

-

Degradation: Actual usable capacity declines over time, whereas in the backtest calculation, we assume nameplate capacity. This contributes around 3% to the difference.

-

Imperfect foresight: The model optimises with knowledge of future prices that operators cannot have in real time. Real-world trading decisions are made with limited visibility of upcoming price movements. This accounts for roughly 10% of the difference.

-

Market competition: Frequency response markets are competitive. Not every submitted bid wins a contract. While the model assumes a level of market saturation based on historical patterns, individual asset success varies.

-

Balancing Mechanism timing: The model optimises Balancing Mechanism participation with 24-hour price foresight. In reality, operators have visibility of only a few hours ahead, leading to less optimal positioning.

Calibration factors vary by scenario

Different macro scenarios apply different calibration adjustments to reflect varying levels of optimism about asset performance:

| Scenario | Calibration Factor |

|---|---|

| Central case | 80% of modelled revenues |

| High case | 85% of modelled revenues |

| Low case | 75% of modelled revenues |

For details on what drives each scenario beyond calibration, see the Scenarios page.

Calibration ensures near-term forecasts match market reality

By anchoring forecasted revenues to observed performance, the calibration delivers two key benefits:

-

Credibility: Near-term revenue projections align with what assets are actually earning today, providing confidence in the forecast methodology.

-

Accuracy: The adjustment captures the cumulative impact of all real-world factors—both those explicitly understood and those that are difficult to quantify individually.

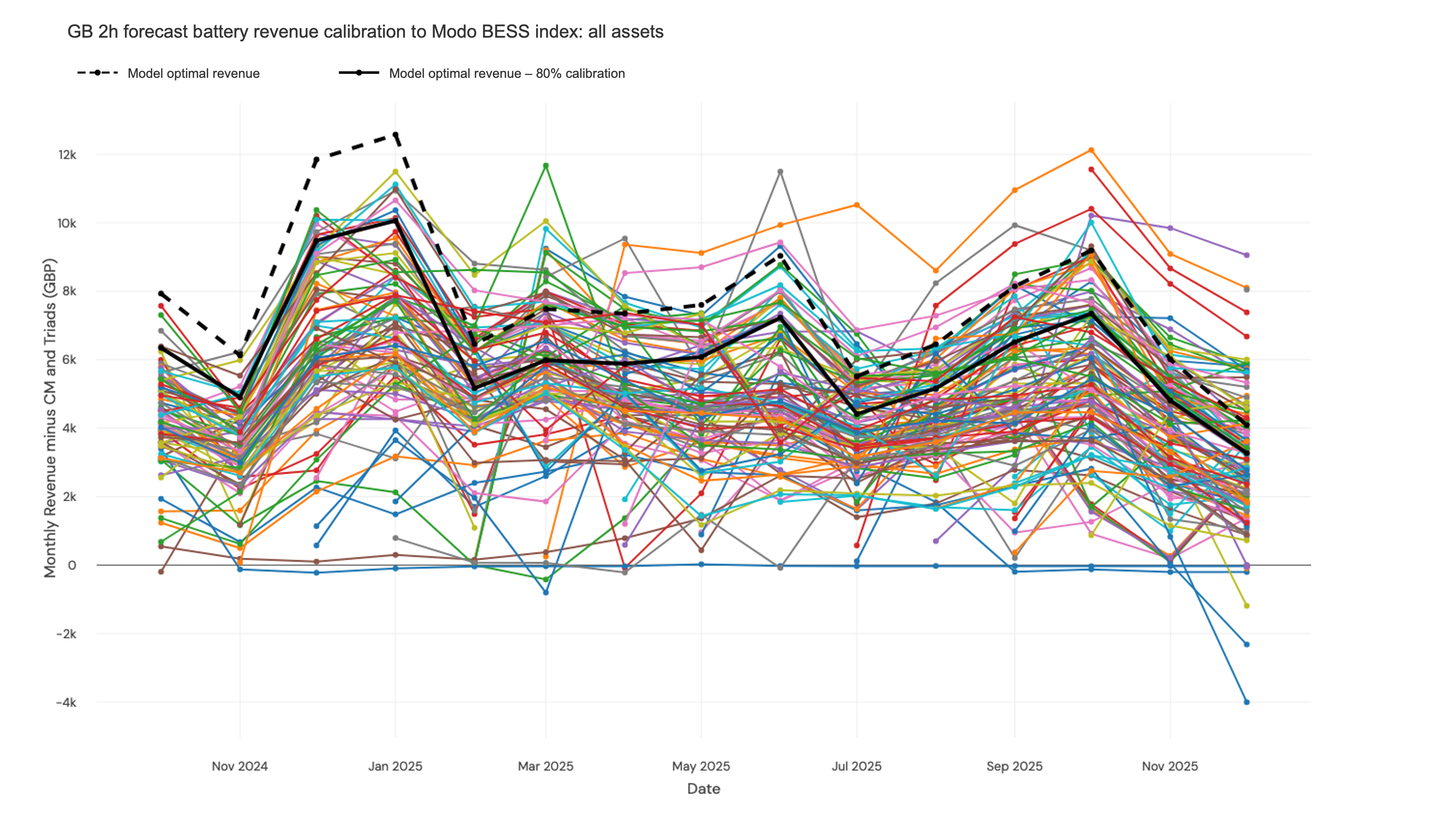

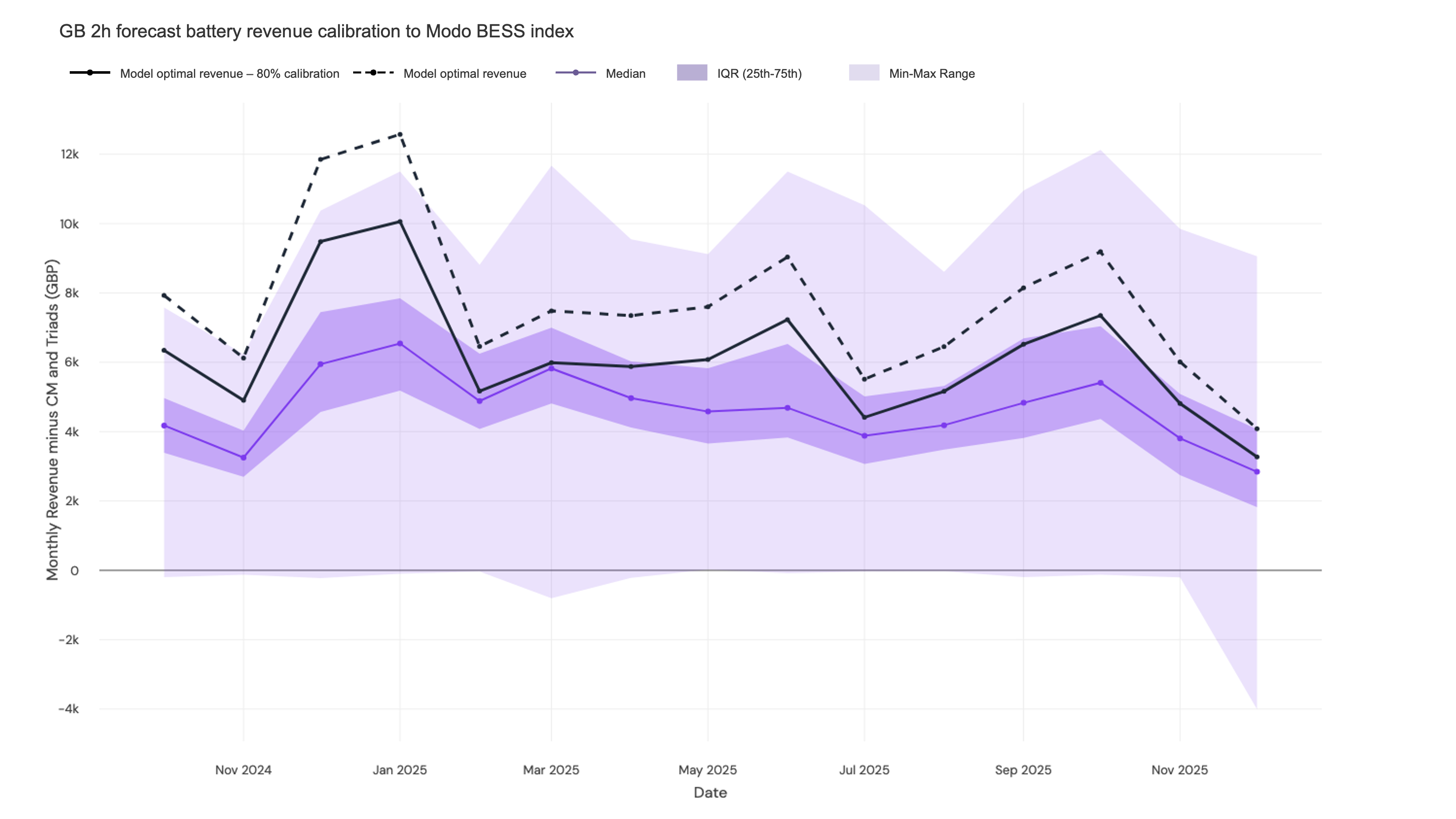

The charts below show the calibration comparison across 2025. Each line represents one of the 130+ tracked assets, illustrating the range of performance across the fleet. This data is aggregated to derive the percentile benchmarks used for calibration.