Here we go into details on our NEM Fundamentals Model. We utilise the same overall framework that powers all of Modo Energy's forecasts. For details of this Core Model, click here.

Our NEM forecast is a 5-minute granularity, substate model that produces outputs to 2055. The forecast models demand, generation, constraints and ultimately prices at a 5-minute settlement period level, which in turn are used as inputs to our battery dispatch model.

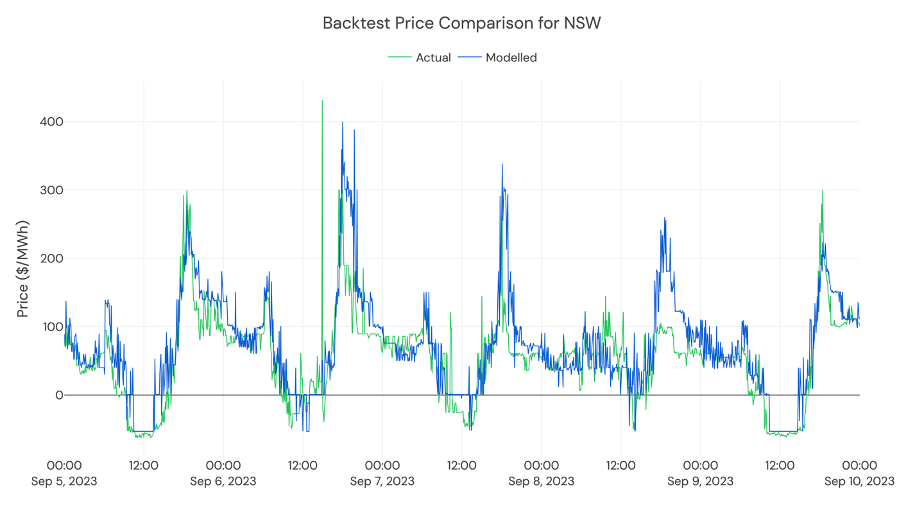

The model runs off assumptions of demand, generation capacities, storage capacities, bidding behaviour, transmission capacities, and outages. We have rigorously tuned our fundamentals model against historical prices to accurately reflect price-setting behaviour. We specifically focus on modelling volatility as a core part of our model, as those periods are especially important to storage revenues. We do this by modelling at 5-minute granularity and by accounting for all types of bids from generators:

- Bids close to the price floor to force the unit to stay online

- Bids close to the short-run marginal cost of the unit

- Bids close to the price cap in order to maximise unit or portfolio revenue

Substate-level modelling

To reflect regional dynamics within the NEM, we model at the substate level and consider transmission limits between substates. We divide the five NEM states into nine distinct regions, based on ISP Subregions. These allow us to capture the main transmission constraints in the NEM in order to model curtailment, and also gives us local prices which can be used to constrain batteries in our dispatch model. These substates are as follows:

- North, Central, and South Queensland

- North, Central, and South New South Wales

- Victoria

- South Australia

- Tasmania

5-minutely pricing

The model runs at 5-minutely granularity to build a full 5-minute time series of energy and FCAS prices through to the end of the model. Modelling at 5-minute granularity is critical to capturing some of the main drivers of price volatility within the NEM, as well as maximising the value that battery energy storage can capture from this.

What are the core inputs?

The model uses a range of inputs, primarily Modo Energy’s independently developed market outlook. This is informed by other sources, including data from NEMWEB and AEMO’s Integrated System Plan (ISP). We update to use the latest ISP data whenever new draft or final versions become available. This outlook is grounded in rigorous market research and informed by deep industry expertise, providing a nuanced view of the future electricity market and capacity landscape. Find out more information by heading to the sub-page for each section.

| Category | Key input sources |

|---|---|

| Demand | AEMO 2024 ISP Demand traces, AEMO 2024 Electricity Statement of Opportunities (ESOO), AEMO MMS, NEMWEB |

| Generation | AEMO 2024 ISP, AEMO 2025 IASR, AEMO April 2025 Generation Information, AEMO MMS |

| Transmission | AEMO 2024 ISP, AEMO Network outage detail |

| Commodity prices | AEMO 2025 IASR, AEMO Daily STTM reports, AEMO DWGM Victorian Wholesale Price, ASX Gas and Coal Futures |

| Renewable load factors | AEMO 2024 ISP, AEMO 2025 IASR, AEMO MMS |

| Marginal loss factors | AEMO Marginal Loss Factors |

| Community energy resources | AEMO 2024 ISP, Clean Energy Regulator, NEMWEB |

| CapEx and OpEx | CSIRO GenCost 2024/25 |

Volatility

How we model price volatility in the NEM

Weather Years

Weather year selection and renewable generation profiles

Unit Commitment Model

Generator commitment and dispatch optimization

Demand

Electricity demand forecasting and assumptions

Generation and Storage

Generation capacity buildout and storage modeling

Transmission

Transmission network constraints and flows

FCAS

Frequency Control Ancillary Services modeling

FCAS Islanding

Modeling FCAS requirements during islanding events

Scenario Modelling

Different market scenarios and sensitivities

Administered Pricing

How we model administered price caps and interventions

Backtest

Model validation against historical data